Check out Investor Copilot custom GPT, which lets you enjoy ChatGPT functionality with recent financial information

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Daily S&P 500 Highs

Data updated 2024-May-13 (Monday)Quick Instructional video for this page. Collapse this after viewing by clicking How-to button above. Open in new tab

Share

Choose condition for frequency distribution

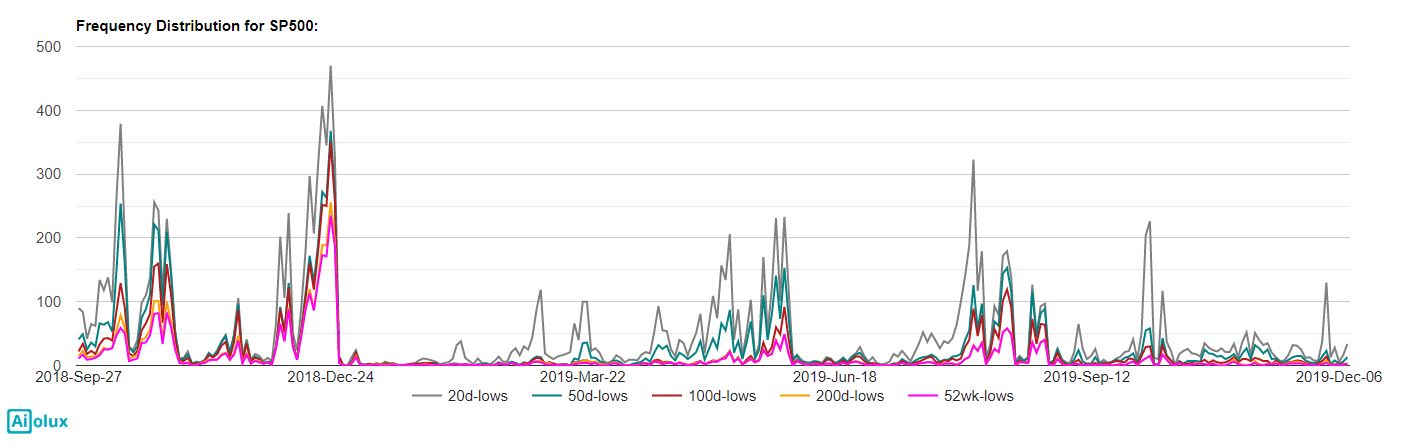

Frequency Distribution of S&P 500 constituents at various period highs updated up to May-13 (Monday). Use blue widget below to further filter by Sector

Use widget to select sectors

Calculation Methodology: Daily highs are compared with highs of key prior periods [20-days, 50-days, 100-days, 200-days, 52-weeks]

Only Current S&P500 constituents are considered (even for historical dates)

Only Current S&P500 constituents are considered (even for historical dates)

How to use this:

Elevated numbers of stocks hitting higher period highs/lows (e.g. 200-day, 52-week) lines may signal major tops/bottoms in the medium-term for the broader market or a particular sector

Similarly elevated levels for shorter period highs/lows indicate overbought/oversold conditions in the shorter term

Interpretation above is not comprehensive but rather just a starting point of understanding. Experienced market professionals typically use a combination of different datapoints to drive decisions

Interpretation above is not comprehensive but rather just a starting point of understanding. Experienced market professionals typically use a combination of different datapoints to drive decisions

Highs/Lows Distribution calculated using current S&P 500 constituents shows number of stocks at key period highs. Table displays S&P 500 stocks hitting key period highs on 2024-May-13

| Symbol | Name | Sector | Max Highs Period |

|---|---|---|---|

| DAL |

Delta Air Lines, Inc.

|

Industrials | 52wk |

| OGN |

Organon & Co.

|

Health Care | 100d |

| MHK |

Mohawk Industries, Inc.

|

Consumer Discretionary | 20d |

| VICI |

VICI Properties Inc

|

Real Estate | 20d |

| EXR |

Extra Space Storage Inc.

|

Real Estate | 20d |

| CCI |

Crown Castle International Corp

|

Real Estate | 20d |

| FMC |

FMC Corp.

|

Materials | 100d |

| AVGO |

Broadcom Inc.

|

Information Technology | 20d |

| REGN |

Regeneron Pharmaceuticals, Inc.

|

Health Care | 20d |

| WAT |

Waters Corp.

|

Health Care | 20d |

| HBAN |

Huntington Bancshares Inc.

|

Financials | 52wk |

| IDXX |

IDEXX Laboratories, Inc.

|

Health Care | 20d |

| TECH |

Bio-Techne Corp

|

Health Care | 100d |

| AMCR |

Amcor Plc

|

Materials | 52wk |

| TER |

Teradyne Inc

|

Information Technology | 52wk |

| KMX |

CarMax, Inc.

|

Consumer Discretionary | 20d |

| INCY |

Incyte Corp.

|

Health Care | 20d |

| COO |

Cooper Companies, Inc.

|

Health Care | 20d |

| AAL |

American Airlines Group, Inc.

|

Industrials | 20d |

| NXPI |

NXP Semiconductors NV

|

Information Technology | 52wk |

| PWR |

Quanta Services, Inc.

|

Industrials | 52wk |

| ON |

ON Semiconductor Corp

|

Information Technology | 20d |

| CNP |

CenterPoint Energy, Inc.

|

Utilities | 100d |

| MNST |

Monster Beverage Corp.

|

Consumer Staples | 20d |

| LH |

Laboratory Corp. of America Hldgs.

|

Health Care | 20d |

| UAL |

United Continental Hldgs., Inc.

|

Industrials | 100d |

| MO |

Altria Group Inc

|

Consumer Staples | 100d |

| HSY |

Hershey Co.

|

Consumer Staples | 100d |

| PFG |

Principal Financial Group, Inc.

|

Financials | 20d |

| EQR |

Equity Residential

|

Real Estate | 200d |

| WMT |

Walmart Inc.

|

Consumer Staples | 20d |

| DOV |

Dover Corp.

|

Industrials | 52wk |

| JPM |

JPMorgan Chase & Co.

|

Financials | 20d |

| FE |

FirstEnergy Corp.

|

Utilities | 200d |

| JCI |

Johnson Controls International plc

|

Industrials | 20d |

| HRL |

Hormel Foods Corp.

|

Consumer Staples | 100d |

| EXPD |

Expeditors International of Wash...

|

Industrials | 20d |

| ROST |

Ross Stores, Inc.

|

Consumer Discretionary | 20d |

| UNH |

UnitedHealth Group Inc.

|

Health Care | 50d |

| HON |

Honeywell International Inc.

|

Industrials | 20d |

| VRTX |

Vertex Pharmaceuticals Inc.

|

Health Care | 20d |

| IRM |

Iron Mountain, Inc.

|

Real Estate | 20d |

| EMN |

Eastman Chemical Co.

|

Materials | 20d |

| AXP |

American Express Co.

|

Financials | 52wk |

| STX |

Seagate Technology PLC

|

Information Technology | 20d |

| APD |

Air Products and Chemicals, Inc.

|

Materials | 50d |

| CL |

Colgate-Palmolive Co.

|

Consumer Staples | 52wk |

| KO |

Coca-Cola Co.

|

Consumer Staples | 200d |

| EIX |

Edison International

|

Utilities | 52wk |

| ETR |

Entergy Corp.

|

Utilities | 52wk |

| LNC |

Lincoln National Corp.

|

Financials | 20d |

| COST |

Costco Wholesale Corp.

|

Consumer Staples | 52wk |

| BLK |

BlackRock, Inc.

|

Financials | 20d |

| AVB |

AvalonBay Communities, Inc.

|

Real Estate | 200d |

| AEP |

American Electric Power Co., Inc.

|

Utilities | 52wk |

| BRO |

Brown & Brown Inc

|

Financials | 20d |

| TMO |

Thermo Fisher Scientific Inc.

|

Health Care | 20d |

| MDT |

Medtronic plc

|

Health Care | 20d |

| SEE |

Sealed Air Corp.

|

Materials | 50d |

| LHX |

L3Harris Technologies Inc

|

Industrials | 52wk |

| ADI |

Analog Devices, Inc.

|

Information Technology | 52wk |

| IFF |

International Flavors & Fragranc...

|

Materials | 52wk |

| USB |

U.S. Bancorp

|

Financials | 20d |

| STT |

State Street Corp.

|

Financials | 20d |

| PSA |

Public Storage

|

Real Estate | 20d |

| C |

Citigroup Inc.

|

Financials | 52wk |

| TPR |

Tapestry, Inc.

|

Consumer Discretionary | 20d |

| UDR |

UDR, Inc.

|

Real Estate | 100d |

| CMI |

Cummins Inc.

|

Industrials | 20d |

| AAPL |

Apple Inc.

|

Information Technology | 50d |

| PEG |

Public Service Enterprise Group Inc

|

Utilities | 52wk |

| SO |

Southern Co.

|

Utilities | 52wk |

| DUK |

Duke Energy Corp.

|

Utilities | 52wk |

| BAC |

Bank of America Corp

|

Financials | 52wk |

| TXN |

Texas Instruments Inc.

|

Information Technology | 52wk |

| STE |

STERIS Corp

|

Health Care | 20d |

| BK |

Bank of New York Mellon Corp.

|

Financials | 52wk |

| FDS |

Factset Research Systems Inc

|

Financials | 20d |

| CBRE |

CBRE Group, Inc. Cl. A

|

Real Estate | 20d |

| LNT |

Alliant Energy Corp

|

Utilities | 50d |

| RTX |

Raytheon Technologies Corp

|

Industrials | 52wk |

| AFL |

Aflac Inc.

|

Financials | 52wk |

| PNW |

Pinnacle West Capital Corp.

|

Utilities | 100d |

| PG |

Procter & Gamble Co.

|

Consumer Staples | 52wk |

| MKTX |

MarketAxess Hldgs. Inc

|

Financials | 20d |

| PEP |

PepsiCo, Inc.

|

Consumer Staples | 100d |

| LW |

Lamb Weston Hldgs. Inc

|

Consumer Staples | 20d |

| PNC |

PNC Financial Services Group, Inc.

|

Financials | 20d |

| NWL |

Newell Brands Inc

|

Consumer Discretionary | 50d |

| T |

AT&T Inc.

|

Communication Services | 20d |

| SRE |

Sempra Energy

|

Utilities | 100d |

| CPB |

Campbell Soup Co.

|

Consumer Staples | 100d |

| ESS |

Essex Property Trust, Inc.

|

Real Estate | 52wk |

| NWSA |

News Corp. Cl. A

|

Communication Services | 20d |

| PAYX |

Paychex, Inc.

|

Information Technology | 20d |

| CTAS |

Cintas Corp.

|

Industrials | 20d |

| MET |

MetLife, Inc.

|

Financials | 20d |

| FIS |

Fidelity National Information Se...

|

Information Technology | 52wk |

| PM |

Philip Morris International Inc.

|

Consumer Staples | 200d |

| XEL |

Xcel Energy Inc.

|

Utilities | 50d |

| FITB |

Fifth Third Bancorp

|

Financials | 52wk |

| MMM |

3M Co.

|

Industrials | 52wk |

| PFE |

Pfizer Inc.

|

Health Care | 20d |

| SHW |

Sherwin-Williams Co.

|

Materials | 20d |

| LEN |

Lennar Corp. Cl. A

|

Consumer Discretionary | 20d |

| WBA |

Walgreens Boots Alliance Inc

|

Consumer Staples | 20d |

| BIIB |

Biogen Inc.

|

Health Care | 20d |

| VFC |

V.F. Corp.

|

Consumer Discretionary | 20d |

| WELL |

Welltower, Inc.

|

Real Estate | 52wk |

| TEL |

TE Connectivity Ltd.

|

Information Technology | 20d |

| ZION |

Zions Bancorporation, N.A.

|

Financials | 50d |

| DE |

Deere & Co.

|

Industrials | 100d |

| BWA |

BorgWarner Inc.

|

Consumer Discretionary | 100d |

| PRU |

Prudential Financial, Inc.

|

Financials | 52wk |

| EFX |

Equifax Inc.

|

Industrials | 20d |

| IVZ |

Invesco Ltd.

|

Financials | 20d |

| HUM |

Humana Inc.

|

Health Care | 20d |

| AMP |

Ameriprise Financial, Inc.

|

Financials | 20d |

| HPQ |

HP Inc.

|

Information Technology | 20d |

| KMI |

Kinder Morgan Inc Cl. P

|

Energy | 52wk |

| WFC |

Wells Fargo & Co.

|

Financials | 52wk |

| CFG |

Citizens Financial Group, Inc.

|

Financials | 52wk |

| QCOM |

QUALCOMM Inc.

|

Information Technology | 52wk |

| TJX |

TJX Companies Inc

|

Consumer Discretionary | 20d |

| ADM |

Archer-Daniels-Midland Co.

|

Consumer Staples | 20d |

| MSI |

Motorola Solutions, Inc.

|

Information Technology | 52wk |

Related Links

Dashboard : Market Pulse using broad themes (e.g. Growth vs. Value, Equities vs. Treasuries etc.)

Snapshots : Popular lists of stocks & etfs (best streaks, most beaten down etc. in last X days)

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Performance Comparison : Chart compare/benchmark performance with multiple assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Analyze & compare Sector performance

Industry : Analyze & compare Industries within Sectors

Breakouts & Breakdowns : Identifying stocks/etfs which recently traded up/down in unusually elevated volumes

Swing Volatility : Identifying stocks/etfs with elevated volatility

World Explorer : Performance & Correlation between key countries across the world

Advance/Decline : Sentiment using accumulated advances & declines in S&P 500 stocks

Highs/Lows : Sentiment using frequency of key highs/lows in S&P 500 stocks Currently Viewing

Moving Average : Sentiment using frequency of S&P 500 stocks above key moving averages

Technical Distribution : Sentiment using frequency distribution of S&P 500 stocks with bullish/bearish technical levels

Snapshots : Popular lists of stocks & etfs (best streaks, most beaten down etc. in last X days)

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Performance Comparison : Chart compare/benchmark performance with multiple assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Analyze & compare Sector performance

Industry : Analyze & compare Industries within Sectors

Breakouts & Breakdowns : Identifying stocks/etfs which recently traded up/down in unusually elevated volumes

Swing Volatility : Identifying stocks/etfs with elevated volatility

World Explorer : Performance & Correlation between key countries across the world

Advance/Decline : Sentiment using accumulated advances & declines in S&P 500 stocks

Highs/Lows : Sentiment using frequency of key highs/lows in S&P 500 stocks Currently Viewing

Moving Average : Sentiment using frequency of S&P 500 stocks above key moving averages

Technical Distribution : Sentiment using frequency distribution of S&P 500 stocks with bullish/bearish technical levels